Often in this society, when a scam is exposed, one must peel it layer by layer like an onion to reveal the stinky green, tear-inducing nubbin at the core. This week’s lesson in “How We Get Screwed Everywhere We Turn” finds us confronting the sticky wicket of student loan debt, and the problem some people have with the idea that other people might get something that helps them.

This is the deal as I have always been given to understand it: If you can, you excel at school. You nail the grades and the extracurriculars, assembling a dossier of achievement that makes you attractive to superior institutions of higher education. If you can, you attend one of those schools, paying for it with scholarships if available or with student loans if possible. Like as not, you accrue debt, but this is done on the promise that the education and training you receive will avail you the kind of future employment whose financial compensation makes such debt endurable.

Thus, the cynic in me is forced to note, are you inducted into The American Way: Your salary provides you with purchasing power that entire industries (maybe even the one you work for!) cater to. You buy a house and staple yourself to a mortgage, you buy cars and furniture and vacations, you have children of your own and aim them toward a future that is now your past … all because you volunteered to lock yourself into a debt cycle that bought the education which provides you with the salary required to participate in that American Way.

… and it can be utterly insidious, how it all goes sideways sometimes. Take my friend the lawyer, for example. She aced her way through high school and got into a top-tier college. She aced college, with the sole exception of an ill-advised foray into the arcane brain cramp of organic chemistry. She wanted to go to law school because she wanted to serve the greater good, and because of her superior grades, she was invited to attend one of the best law schools on the Eastern seaboard.

By the time she was finished with college and law school, my friend the newly minted lawyer had a pile of student debt on her back large enough to enjoy its own gravity. The advocacy groups, the public defender’s office, all the places she wanted to apply her talents and intentions, paid far too little for her to be able to manage her debt, and so she wound up at a desk by the window of a glass-and-steel cage 30 stories above downtown, another associate “grinder” at another corporate law firm.

Want to know why corporations always seem to win? That’s why. My friend the lawyer, who wanted to save the world, took a job in corporate law “just for a few years,” she said at the time, until her six-figure debt was paid off. Like so many who came before her, the talents she brought to the table became another tool corporate America uses to maintain its supremacy by way of the courts. She dared to start a family and buy a house, and the siren song of that salary drowned out all the earlier aspirations that buried her in debt to begin with. It is an old story, all too often repeated.

There you have it. How do you get the smartest students in the country to work defending the rights and power of corporations? Bury them in debt and then lure them into six-figure careers – perhaps a partnership, or even a judge’s robe down the road – spent defending those corporations in court. So long as these students are shackled to debt, torrents of them will be available to make sure oil companies will never know a reckoning for, for example, turning the Gulf of Mexico into a death zone. This frees up money for the corporations to buy politicians who bring things like Citizens United to life, and the wheel goes round.

The way The Way works – the only way it works – is if there are legitimate means to pay down that accrued debt once the schooling is finished. Otherwise, it’s all just another O Henry! story.

In truth, it’s actually simpler than that, and worse. My friend the lawyer had her choices and made them, but a great many debt-riddled students today face a future starkly denuded of opportunities. The way The Way works – the only way it works – is if there are legitimate means to pay down that accrued debt once the schooling is finished. Otherwise, it’s all just another O Henry! story, a bait and switch that has people doing what they are expected to do, only to get hosed after they walk the stage to grasp that suddenly worthless diploma.

Welcome to the world endured by millions of student debt holders. Education is more expensive by orders of magnitude than it was 20 years ago, and post-education opportunities have become brutally scarce in an economy that tends to eat itself every so often. Too many people from previous generations enjoyed privileges afforded by things like the G.I. Bill and properly funded public schools, climbed to the top of the ladder, and then pulled the ladder up behind them.

How? By voting for Republicans who hate public money and public schools, and why? To pay less taxes. It wasn’t Millennials or Gen Z who threw 74 million votes at Donald Trump in 2020, but a whole lot of them did what was expected of them and got an expensive education on the promise of future opportunity, only to find that ladder missing and their grandparents waving at them from the now-unattainable economic high ground.

The irony here has poison dripping from its fangs.

“On Wednesday,” reports Politico, “[President Joe] Biden finally signed off on his highly anticipated student loan assistance package. The plan will deliver hundreds of billions of dollars of relief to tens of millions of borrowers and transform the federal government’s student loan program.”

Finally, after two years of deliberations, we have come to another typical Biden administration moment: a decision to do less than what is required but more than many actually believed could happen.

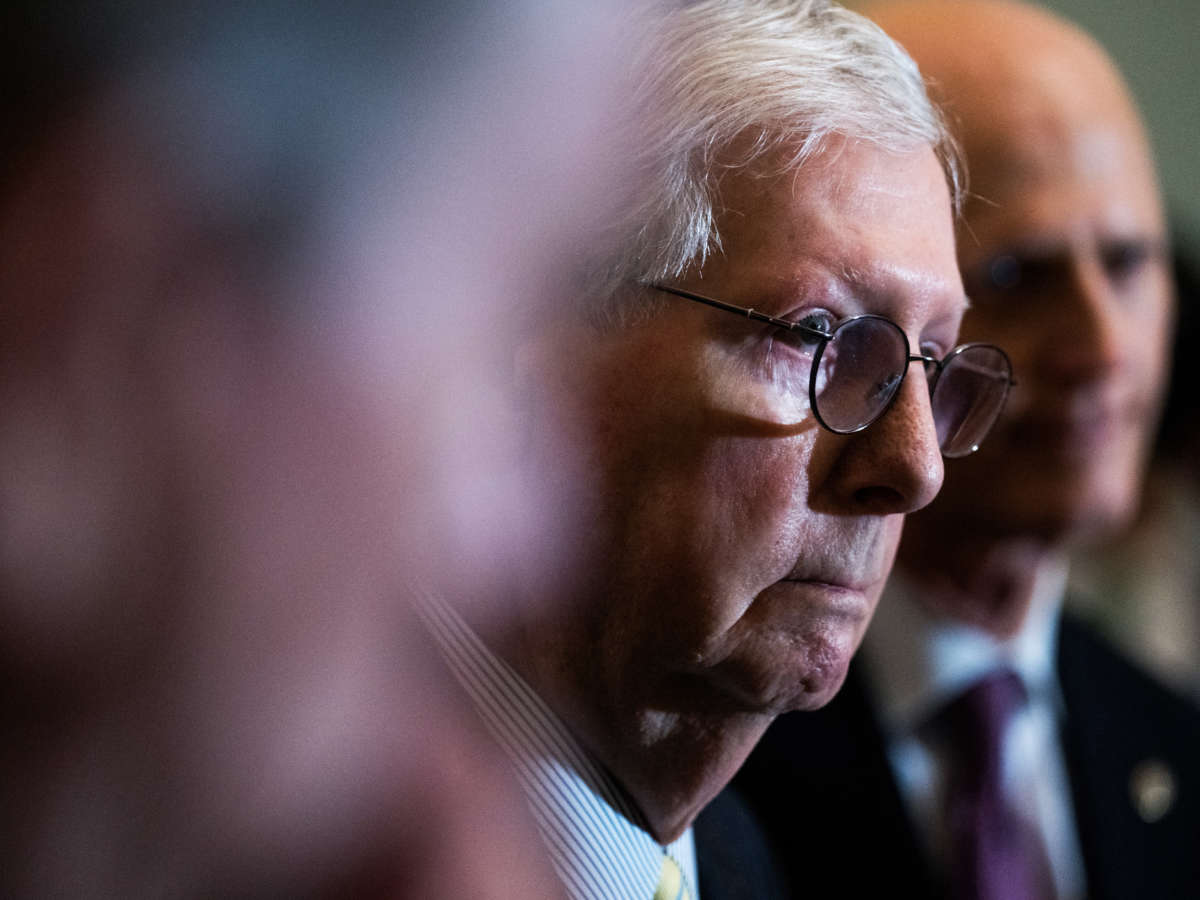

Biden’s student debt relief plan has inspired howls of outrage from Republicans desperate for something to howl about with the midterms looming. Cries of “socialism!” and “deadbeats!” rattled the Murdoch portraits on the walls of Fox News. Senate Minority Leader Mitch McConnell called Biden’s plan a “slap in the face to every family who sacrificed to save for college,” and House Minority Leader Kevin McCarthy labeled the plan a “debt transfer scam.”

Tuition for student McConnell was $330, and tuition for student McCarthy was $800. Even a cursory peek at a college rankings magazine will immediately reveal that the salad days of affordable education are on the same extinction list as the dodo and the brontosaurus. Put another way: Nearly 30 years after I graduated, tuition at my alma mater runs in excess of $72,000 a year. Think I’d be going there today with that price tag attached? Think again … and I’m Gen X. I remember when gasoline was less than two bucks a gallon. It ain’t like it used to be, Mitch. Maybe you missed the memo, dated 2001 to the present.

You’d like to think the Republicans in high dudgeon over debt relief are trying to make a point without the usual dollop of hypocrisy on the side – you go into debt, you pay your debt – but you would be wrong to all points on the compass.

Too many people from previous generations enjoyed privileges afforded by things like the G.I. Bill and properly funded public schools, climbed to the top of the ladder, and then pulled the ladder up behind them.

GOP Reps. Vern Buchanan, Marjorie Taylor Greene, along with Mike Kelly, Markwayne Mullin and Kevin Hern got mouthy over the unfairness of it all. Which is kind of strange upon further analysis. During the height of the pandemic, each and every single one of them took advantage of the debt forgiveness available in the Paycheck Protection Program (PPP). Greene had $183,504 in PPP loans forgiven. Kelly had $987,237 in loans forgiven. Buchanan had more than $2.3 million in PPP loans forgiven, and is now calling Biden’s new policy “reckless.”

Biden’s debt relief plan is not nearly enough to ameliorate the generational economic screwing currently endured by millions, but it helps. It helps if only to acknowledge the reality that The American Way, which was never available to all, is now a debt trap designed to lock people into a permanent financial scramble even as their few remaining coppers are wrung from their bones.

If you’re an advocate for The Way, you want these people to buy houses and cars and become part of the system, right? Like a Ponzi scheme, participation is the only way it works. The money freed up by this debt forgiveness is somebody’s down payment on a mortgage. That’s the whole point, right? Hello? Is this thing on?