Comes after Texas State Board of Education cancelled $8.5 billion contract with major asset manager.

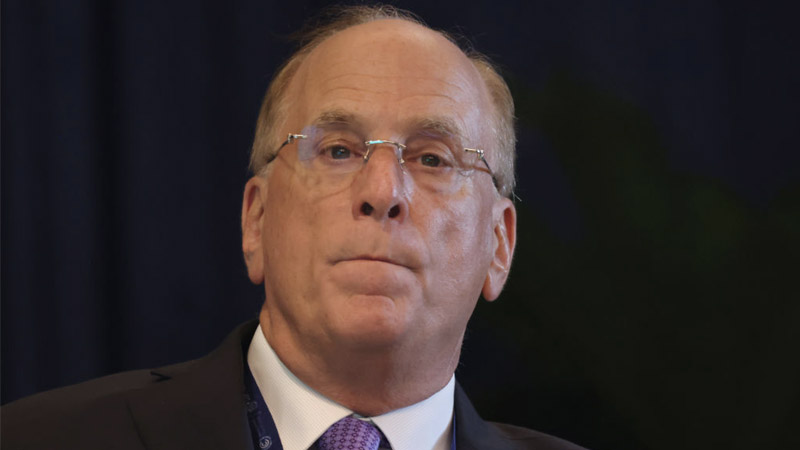

BlackRock CEO Larry Fink lost his cool during the company’s latest earnings call this week after the Texas Board of Eduation cancelled an $8.5 billion contract with the asset manager over its ESG agenda.

“We have done a better job now of telling our story so that people can make decisions based on facts, not on lies and not on misinformation or politicization by others,” Fink said during a first quarter earnings call.

JUST IN: @BlackRock CEO Larry Fink *absolutely lost it* on their latest earnings call, after the Texas Permanent School Fund pulled $8.5 billion from the woke asset manager over their continued ESG activism:

— Will Hild (@WillHild) April 12, 2024

“Unfortunately, there’s still others out there…who continuously lie about these issues,” he added.

Texas State Board of Education Chairman Aaron Kinsey severed ties between BlackRock and the Texas Permanent School Fund last month to punish the company for allegedly “boycotting” oil and gas as part of its ESG initiative, which Fink has denied.

BlackRock’s “dominant and persistent leadership in the ESG movement immeasurably damages our state’s oil & gas economy,” Kinsey said.

Today, Texas Permanent School Fund leadership delivered an official notice to global asset manager BlackRock terminating its financial management of approximately $8.5 billion in Texas’ assets.

My statement: pic.twitter.com/wf79a1jZlf

— Aaron Kinsey (@AaronKinseyTX) March 19, 2024

“BlackRock’s destructive approach toward the energy companies that this state and our world depend on is incompatible with our fiduciary duty to Texans,” he added.

But Fink has claimed that BlackRock “has never supported divesting from traditional energy firms” and currently has $300 billion invested in such companies.

BlackRock’s stock is down overall in 2024, while the S&P 500 has risen around 8% in recent months, according to Yahoo Finance data.