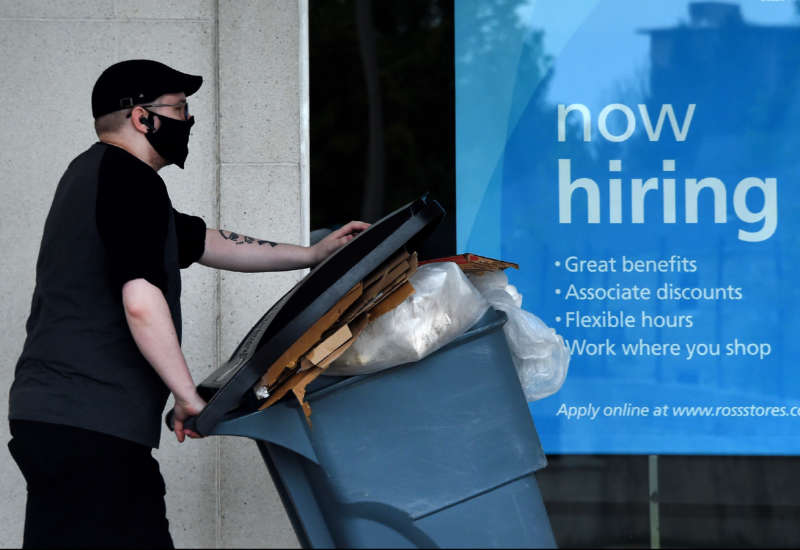

New data from the U.S. Bureau of Labor Statistics (BLS) shows that the number of people quitting their jobs has surged to record highs, with retail and hospitality workers driving the surge. The data suggests that an increasing number of workers are unwilling to risk contracting COVID for the sake of their low-paying jobs.

The number of resignations, or “quits,” surged to 4.3 million in August — the highest number since agencies began collecting such data in December of 2000. New data also reveals that job creation has continued to slow in recent months, sinking to disappointing lows in September, when extra unemployment benefits from the stimulus package ended.

The industry that saw the largest proportion of quits was the hospitality industry, particularly the food service industry. Retail workers also quit at higher rates than workers in other industries. The rise in quits coincided with the surge of COVID cases across the U.S. over the past few months, hitting highs in August and early September.

The possibility that resignations are tied to a rise in COVID cases is further supported by regional data. People in the South and Midwest — regions that were hit with higher rates of COVID infections and deaths over the past few months — quit at higher rates than those in the Northeast, where COVID infections were less widespread.

Economists usually interpret a high number of quits to be a positive sign for the job market, assuming that people leave positions with confidence that they’ll find another job soon. But this may not hold true as COVID continues to rock the already-fragile economy.

This summer, employers and conservative lawmakers predicted that ending unemployment insurance in September would drive people to work, but the opposite proved true. In the 26 states that ended extra unemployment benefits early — most of which were led by conservative governors — employment rates actually slowed to about half the rate of states that kept the benefits until September.

Economic studies have drawn similar conclusions: When people don’t have enough money to get by, as is currently the case for a huge portion of the U.S., they spend more time managing scant resources and less time job searching, economists say. Unemployment can also have long-term effects on people’s personal finances, leading to lower lifetime earnings.

According to a post by the Economic Policy Institute (EPI) last month, lawmakers hoping to increase employment rates should focus on strengthening social programs that could ease these worries for workers. “Policymakers should prioritize efforts to bolster job growth, protect those still unable to find suitable work, and build a more equitable economy than what existed before the pandemic,” EPI wrote, adding that states should invigorate programs like education.

Though it’s unclear exactly why retail and hospitality workers are currently quitting at such high rates, personal and familial concerns may be playing a role. A report earlier this year by One Fair Wage found that restaurant workers were likely to quit over COVID concerns and low wages. The report also found that COVID creates risks for workers who are unlikely to get health insurance from their jobs — and that workers are experiencing increased harassment during the pandemic, which is worsening their job satisfaction.

Employment may also be impacted by family-related responsibilities. In May and June, a Harvard Business Review survey found that during the pandemic, 20 percent of working parents had to reduce their hours or quit their jobs entirely to help with childcare. All the while, childcare facilities have reported being understaffed, and parents have experienced burnout and exhaustion as the pandemic stretches on — now worrying about rising COVID infections in children as schools have reopened.

While conservatives circulate spurious talking points about people not wanting to work, they are fighting tooth and nail against Democratic proposals that could save or create jobs. Their recent opposition to raising the debt ceiling could cost 6 million jobs if the U.S. defaults on its debts. And the GOP and conservative Democrats have been rallying against the relatively inexpensive reconciliation bill, which could create over 4 million jobs annually.