An analysis released Wednesday shows that the multi-billionaire chief executive spearheading Starbucks’ aggressive and unlawful union-busting campaign has gotten $940 million richer during the coronavirus pandemic as employees at the coffee chain have struggled to get by on low wages.

Compiled by the progressive group Americans for Tax Fairness (ATF), “Billion-Dollar Union Busters: How Starbucks and Its Rich CEO Are Stifling Worker Organizing” was published as the nationwide unionization drive at the coffee chain continues to grow in the face of increasingly brazen opposition from management, with more than 200 locations voting to join Workers United since December 2021.

“Starbucks and its billionaire CEO, Howard Schultz, can well-afford to improve employees’ pay and working conditions through unionization,” reads the new report. “Schultz’s personal fortune increased by nearly $1 billion during the Covid pandemic, leaping to nearly $4 billion today. Over the last decade his wealth has increased by about $640,000 a day on average, or more money in a single day than most of his store employees are likely to make from Starbucks in a lifetime.”

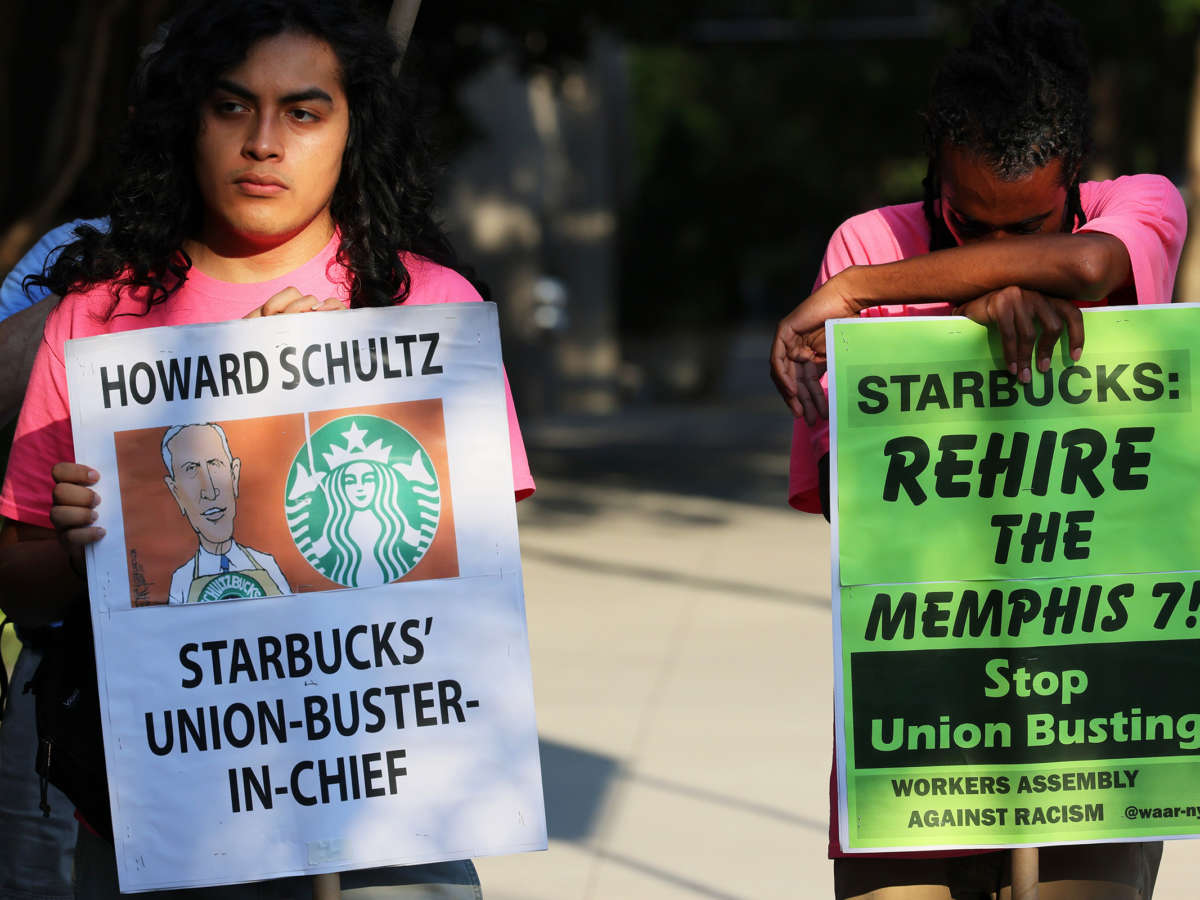

Schultz retook the helm at Starbucks in an interim capacity earlier this year as the unionization push spread rapidly to coffee shops across the country. Given his long history of union-busting, Schultz’s return was widely viewed as part of the corporation’s attempt to crush organizing momentum.

While recent data shows the union drive slowed slightly last month, the number of stores filing for union elections and winning is still rising at a striking pace, an indication that Starbucks’ aggressive anti-union tactics — from firing organizers to denying unionized workers wage and benefit improvements — have thus far been largely unsuccessful.

“As of early August 2022, Starbucks had racked up 276 unfair labor practice charges,” ATF notes in its report, which comes just ahead of Labor Day.

Zachary Tashman, a research and policy associate at ATF and the new report’s lead author, said in a statement Wednesday that “the ruthless union-busting strategy used by Starbucks and its billionaire CEO is a perfect example of how far wealthy corporations are willing to go to keep their profits concentrated in just a few hands.”

The report points out that Starbucks netted $4.1 billion in pre-tax profits in 2021, up 457% from the previous year, when the coronavirus pandemic took a significant toll on operations.

“Starbucks can certainly afford to pay its workers more and offer them better benefits,” the report continues. “Kevin Johnson, the CEO of Starbucks until March of this year, was rewarded with $20.4 million in compensation in 2021, a bump of nearly $5.8 million (39.3%) from 2020.”

Though Schultz rejoined the company as interim CEO with a salary of $1, he brought in huge pay packages during his two previous stints as Starbucks’ chief executive and remains a major shareholder, buying $10 million of the corporation’s stock earlier this year.

“His booming fortune has not made Schultz generous with his employees,” ATF states in its report. “His personal pandemic wealth gains of $940 million alone could pay for a $3,847 bonus for every Starbucks worker. But instead Schultz has tried to divide Starbucks workers by offering a 5% to 7% wage increase only to stores that refuse to unionize, a likely violation of federal labor laws.”

Starbucks has also benefited from the 2017 GOP tax law, which slashed the corporate tax rate from 35% to 21%. ATF observes that “in the four years since enactment of the Trump tax cuts, Starbucks’ effective federal income tax rate fell from 28.1% to 18.2% compared to the 2014-17 period.”

“In two of the post-Trump-GOP tax cut years, 2018 and 2020, Starbucks only paid an effective federal tax rate of 5.8% and 3.3%, respectively,” the report reads.

To help combat Starbucks’ union-busting, ATF urges Congress to hike the corporate tax rate to at least 28% and pass the No Tax Breaks for Union Busting Act, recently introduced legislation that would “classify corporate interference in worker organization campaigns as political speech under the tax code, thereby revoking its tax deductibility.”

Rep. Donald Norcross (D-N.J.), a lead sponsor of the bill, said Wednesday that “there would be no Starbucks without the thousands of employees who show up to work, including during the pandemic.”

“But our tax code favors corporate bosses at the expense of working people,” Norcross added. “Wealthy CEOs shouldn’t be rewarded with American tax dollars for crushing their employees. We need to pass bills like the No Tax Breaks for Union Busting Act to level the playing field for workers.”